Active Trading can often be stressful, time-consuming, and yield unsatisfactory outcomes. If you're an investor seeking a less demanding and time-consuming investment strategy or simply want a more passive investment style, there are alternative options to Active Trading in SushiSwap. These include staking, lending assets, participating in mining pools, and more.

If you're not sure how to start investing in the markets or how to build a longer-term position with reduced risks, this article discusses an investment strategy called dollar-cost averaging (DCA). DCA is a simple and effective way to enter a position and minimize the risks associated with market volatility.

Dollar Cost Averaging

Dollar-cost averaging (DCA) is a popular investment strategy designed to mitigate the effects of market volatility when buying assets. It involves consistently investing equal fiat amounts into an asset at regular intervals.

The assumption is that this approach can help reduce the impact of volatility, compared to making a single lump sum payment. By buying at regular intervals, the strategy helps to smooth out the average purchase price over time. This long-term approach minimizes the negative impact that a potentially unfavorable entry point could have on your investment. In the following sections, we will explore the mechanics of dollar-cost averaging and the reasons why it can be a beneficial strategy to consider.

Why use DCA?

DCA and Market Timing

The primary advantage of dollar-cost averaging is that it helps reduce the risk of making an incorrect trade or investment decision due to poor market timing. Timing the market accurately is a challenging task. Even if the trade direction is correct, poor timing can lead to unfavorable results. By dividing the investment into smaller, regular chunks, the DCA strategy aims to achieve better outcomes than investing in a single lump sum.

Moreover, using dollar-cost averaging can also help eliminate some decision-making biases. Once you commit to this strategy, it will make the investment decisions for you, removing any emotional impulses that may impact your judgment.

However, it's important to note that dollar-cost averaging doesn't entirely eliminate investment risk. Its goal is to smooth the entry into the market, minimizing the risk of poor timing. To make a successful investment, other factors must be considered in addition to this strategy.

Consider Your Exit Strategy

As previously discussed, accurately timing the market is an incredibly challenging task, even for experienced traders. Therefore, if you have dollar-cost averaged into a position, it is essential to consider your exit plan or trading strategy for when you decide to sell.

If you have established a specific target price or price range, determining your exit strategy becomes relatively straightforward. Similar to the dollar-cost averaging approach, you can divide your investment into equal portions and start selling them as the market approaches your target price. By doing so, you can reduce the risk of potentially missing the optimal exit point. However, it is crucial to note that the specifics of your individual trading system will ultimately govern these decisions.

Adopting a Buy and Hold Strategy

Alternatively, some investors adopt a "buy and hold" strategy, where their goal is to retain the assets for an extended period, anticipating its continuous appreciation over time. This approach implies a long-term investment horizon with a focus on capital appreciation, rather than short-term trading.

Certain assets may have short periods of recession, but they still remain on a continual uptrend. The objective of the "buy and hold" strategy is to enter the market and maintain a long-term position so that the timing of individual trades becomes less significant. It's important to note that this strategy is commonly associated with the stock market and may not directly translate to the dynamics of the cryptocurrency markets.

DCA Example

To illustrate this strategy, let's consider an example. Suppose we have a fixed amount of $10,000, and we believe it's reasonable to invest in Bitcoin. We anticipate that the price will fluctuate within the current range, making it a favorable moment to accumulate and establish a position using a dollar-cost averaging approach. We can divide the $10,000 into 100 equal portions of $100. Every day, regardless of the Bitcoin price, we will purchase $100 worth of Bitcoin. By doing so, we spread out our entry over a period of approximately three months.

Now, let's explore the flexibility of dollar-cost averaging with a different scenario. Suppose Bitcoin has entered a bear market, and we don't expect a sustained bull trend for at least two more years. However, we anticipate a future bull trend and wish to prepare in advance. Should we employ the same strategy as before? Probably not. This investment portfolio now has a much longer time horizon. We must be prepared to allocate this $10,000 for a few more years. So, what approach should we adopt? We can divide the investment into 100 portions of $100. However, this time, we will purchase $100 worth of Bitcoin every week instead of every day. With approximately 52 weeks in a year, the entire strategy will span slightly less than two years.

By following this approach, we gradually build a long-term position while the downtrend continues. We avoid missing out on the upturn when the bull trend eventually begins, and we also mitigate some of the risks associated with buying during a downtrend.

It's important to note that this strategy carries inherent risks, considering we are buying during a downtrend. For certain investors, it may be preferable to wait until the end of the downtrend is confirmed before entering the market. Although waiting may result in a higher average cost or share price, it helps mitigate a significant portion of the downside risk in return.

Dollar-Cost Averaging Calculator

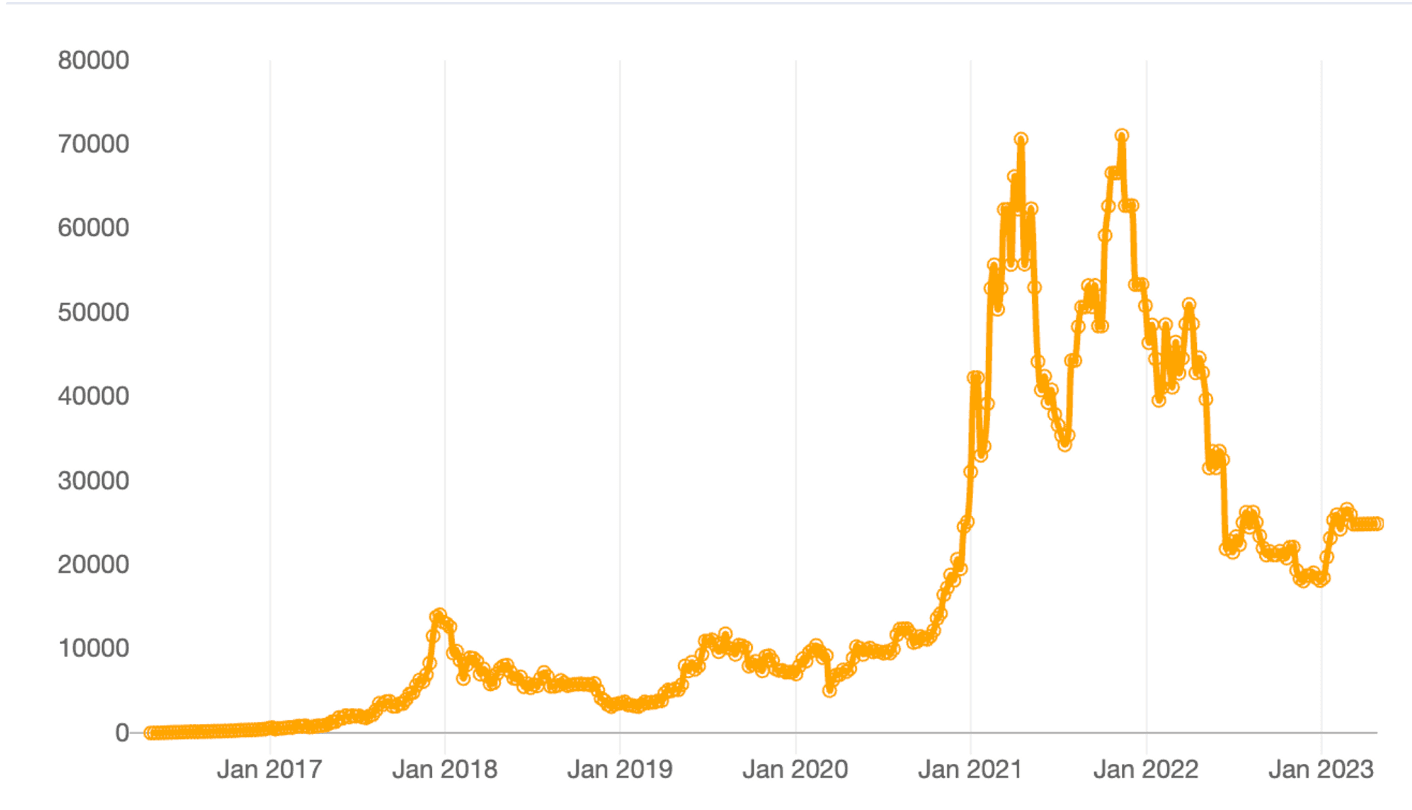

An excellent dollar-cost averaging calculator for Bitcoin can be found on dcabtc.com. This calculator allows you to input the desired investment amount, time horizon, and intervals, providing insights into how various strategies would have performed over time. Particularly with Bitcoin, which has shown a sustained uptrend in the long run, you will discover that the strategy has consistently yielded favorable results.

Here is an example showcasing the performance of an investment strategy where only $10 of Bitcoin was purchased every week over the past seven years. Initially, $10 per week may not seem significant. However, as of April 2023, the total investment would have been around $3,600, and the Bitcoin holdings would have been valued at almost $25,000.

Arguments Against DCA

While dollar-cost averaging is generally considered a beneficial strategy, it is not without its skeptics. Its effectiveness is most prominent in volatile markets, where significant price swings occur, as the strategy aims to mitigate the impact of such volatility.

However, some argue that dollar-cost averaging can potentially hinder gains during sustained bull markets. The rationale behind this argument is that investing earlier in a bull trend typically yields better results. Consequently, dollar-cost averaging may dampen the potential gains during an upward market trend. In these cases, lump sum investing has the potential to outperform dollar-cost averaging.

Nevertheless, it is important to note that many investors do not possess a large sum of money available for a single investment. For individuals who can only invest smaller amounts over an extended period, dollar-cost averaging remains a viable and suitable strategy to participate in the market.

Dollar-cost averaging is a valuable strategy that allows investors to enter positions while mitigating the impact of market volatility. By dividing the investment into smaller portions and purchasing at regular intervals, this approach offers several advantages.

One of the primary benefits of dollar-cost averaging is its ability to eliminate the need for precise market timing. This is particularly beneficial for investors who prefer a more passive approach and do not wish to constantly monitor market fluctuations.

Despite the criticisms from skeptics suggesting that dollar-cost averaging may cause some investors to miss out on gains during bull markets, it is important to recognize that for many, the potential loss of some gains is not necessarily a significant concern. Dollar-cost averaging remains a convenient and accessible investment strategy that accommodates investors with limited funds or those seeking a less active investment approach.

Overall, DCA provides a practical and disciplined approach to investing, enabling individuals to navigate the markets with reduced risk and a long-term perspective.

Exchange | Furo | Docs | Discord | Twitter | Telegram | Newsletter | YouTube | Github