Be a Crypto Chef with SushiSwap!

Sushi is one of the most used decentralized exchanges, deployed on 10+ blockchains, and supporting thousands of tokens. You can trade, earn, stack yields, lend, borrow, leverage all on one decentralized, community driven platform. Welcome to the home of DeFi: https://sushi.com/

💡 Before you can provide liquidity you'll need to have the $BRICK token and another token e.g. $ETH in your wallet. Follow these steps if you want to learn more about buying & selling your $BRICK tokens.

🍣 What does providing liquidity mean?

Liquidity Providers (LPers) provide pool liquidity on the Sushi Exchange to improve $BRICK market efficiency and earn trading fees. Liquidity providers receive a portion of trading fees corresponding to their “pool share”.

💰 How to add $BRICK to Sushi as a Liquidity Provider (LP)

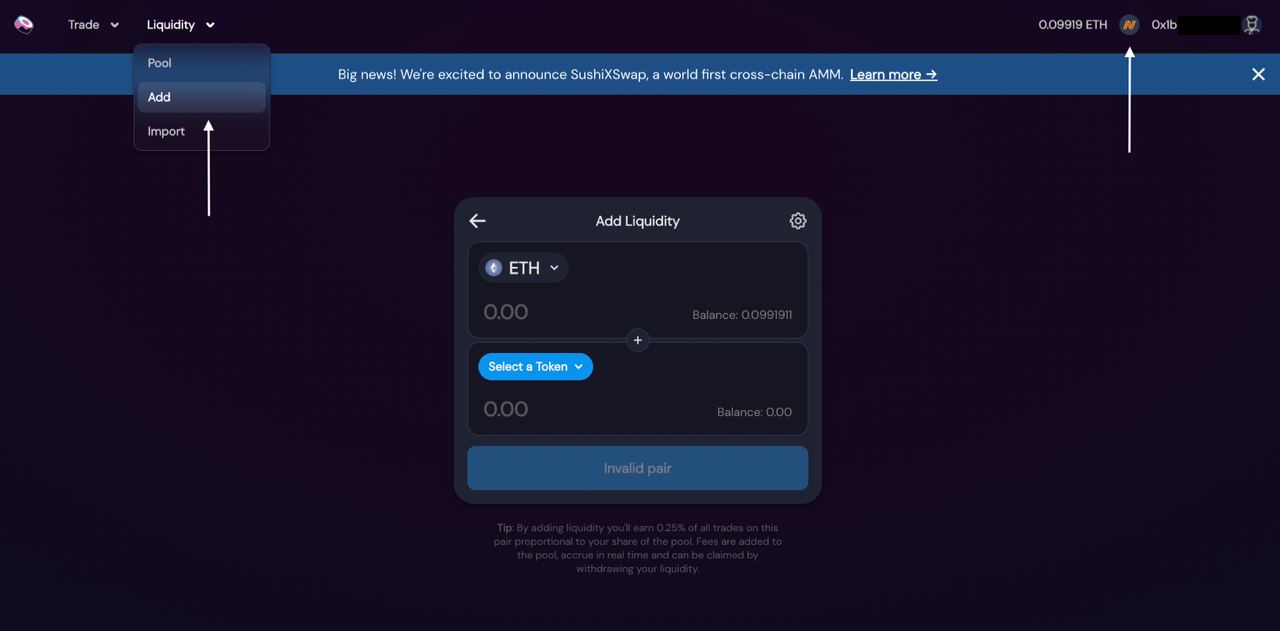

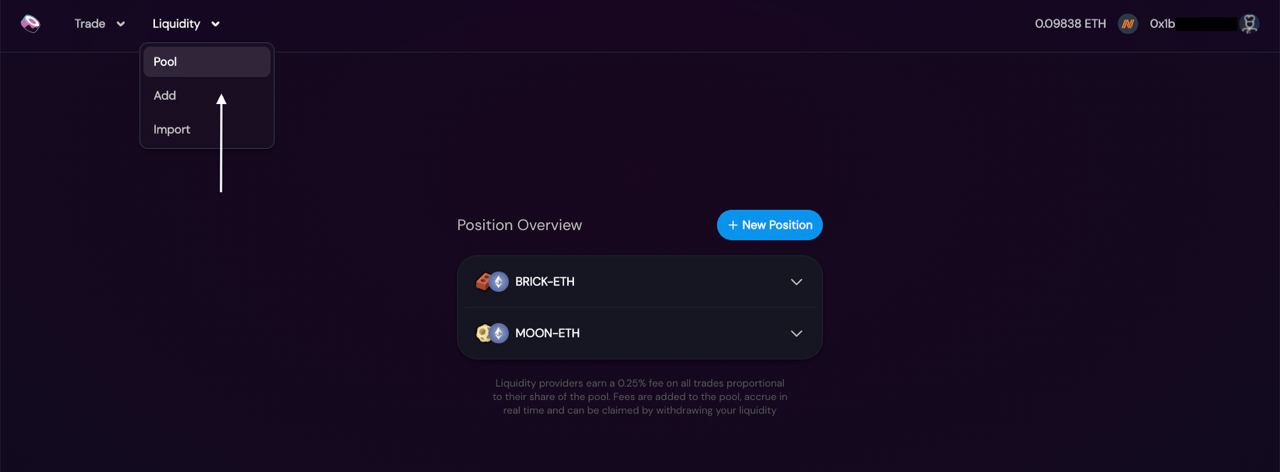

Connect your wallet (MetaMask in this example) to Sushi and head over to "Liquidity" in the menubar.

(Make sure you're connected to the Arbitrum Nova network)

Then click on "Add" in the menubar, this will lead you to this page.

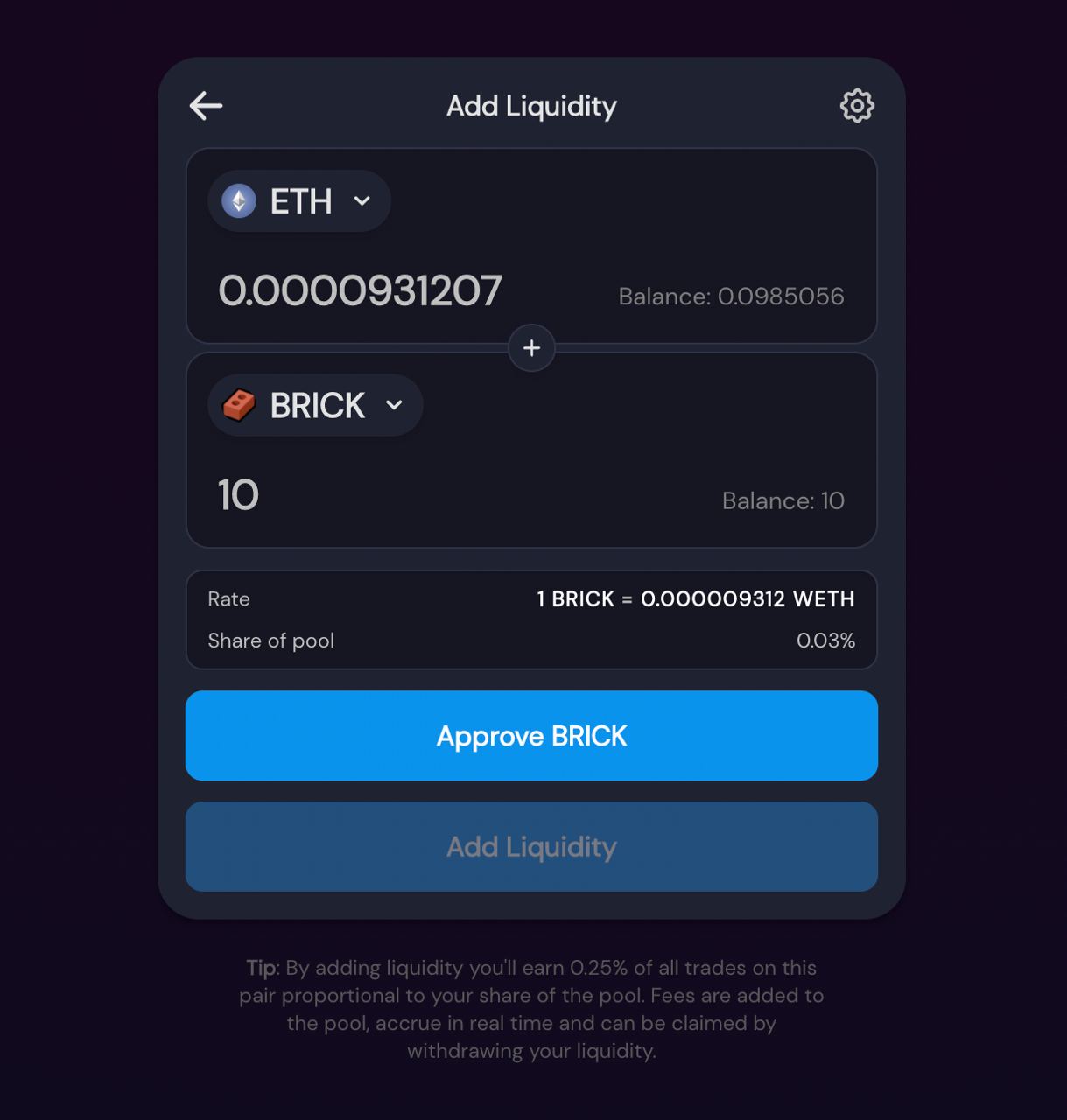

Select the $BRICK and ETH token amounts you would like to add to the liquidity pool.

Note: Both tokens will automatically represent a 50/50 balance, make sure you have enough tokens of each in your wallet

Approve $BRICK token (if you haven't already).

Confirm Adding Liquidity.

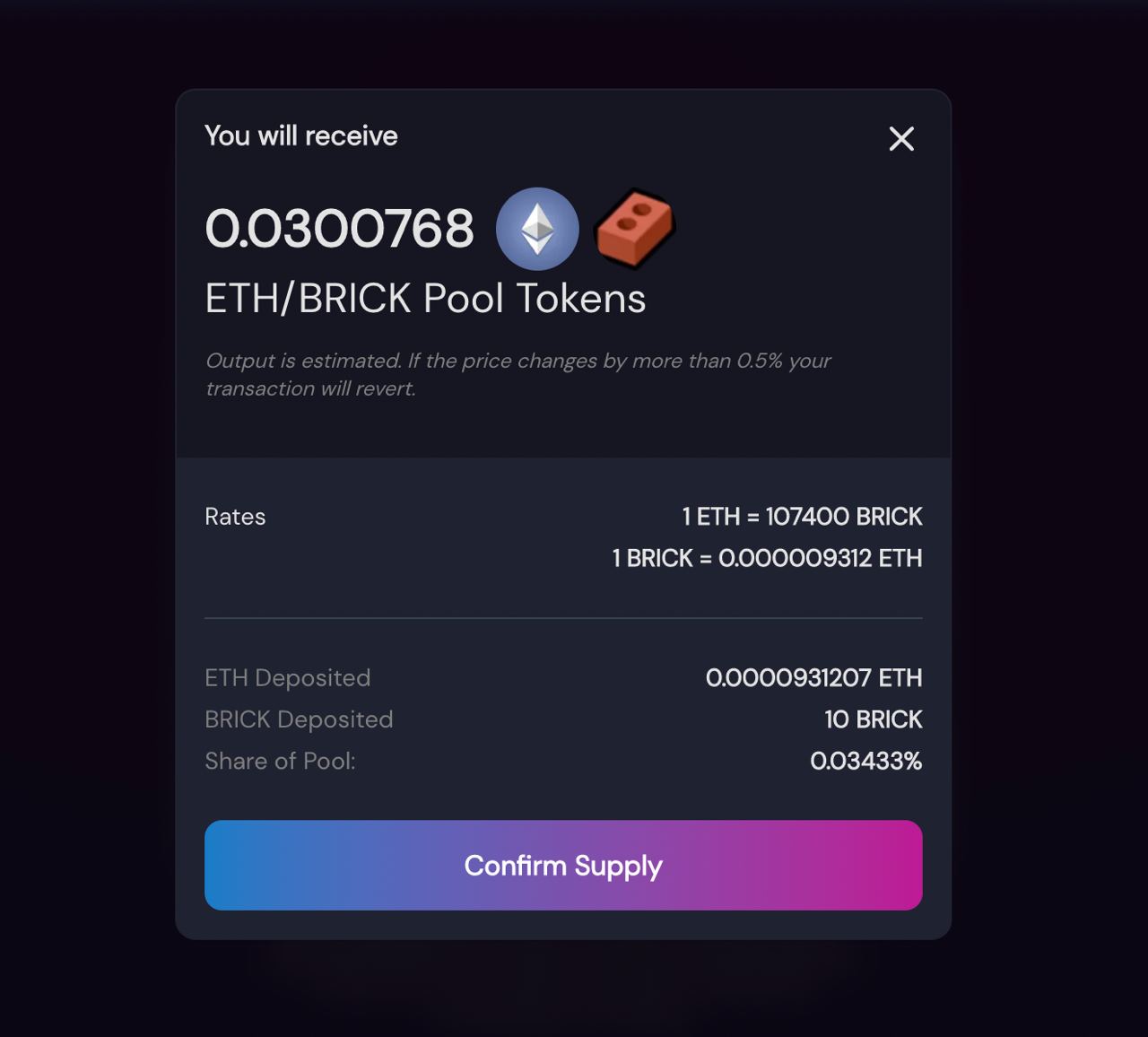

Check the amount of $BRICK/ETH Pool Tokens (SLP) you will receive. Press Confirm Supply when ready and sign transaction in your Wallet.

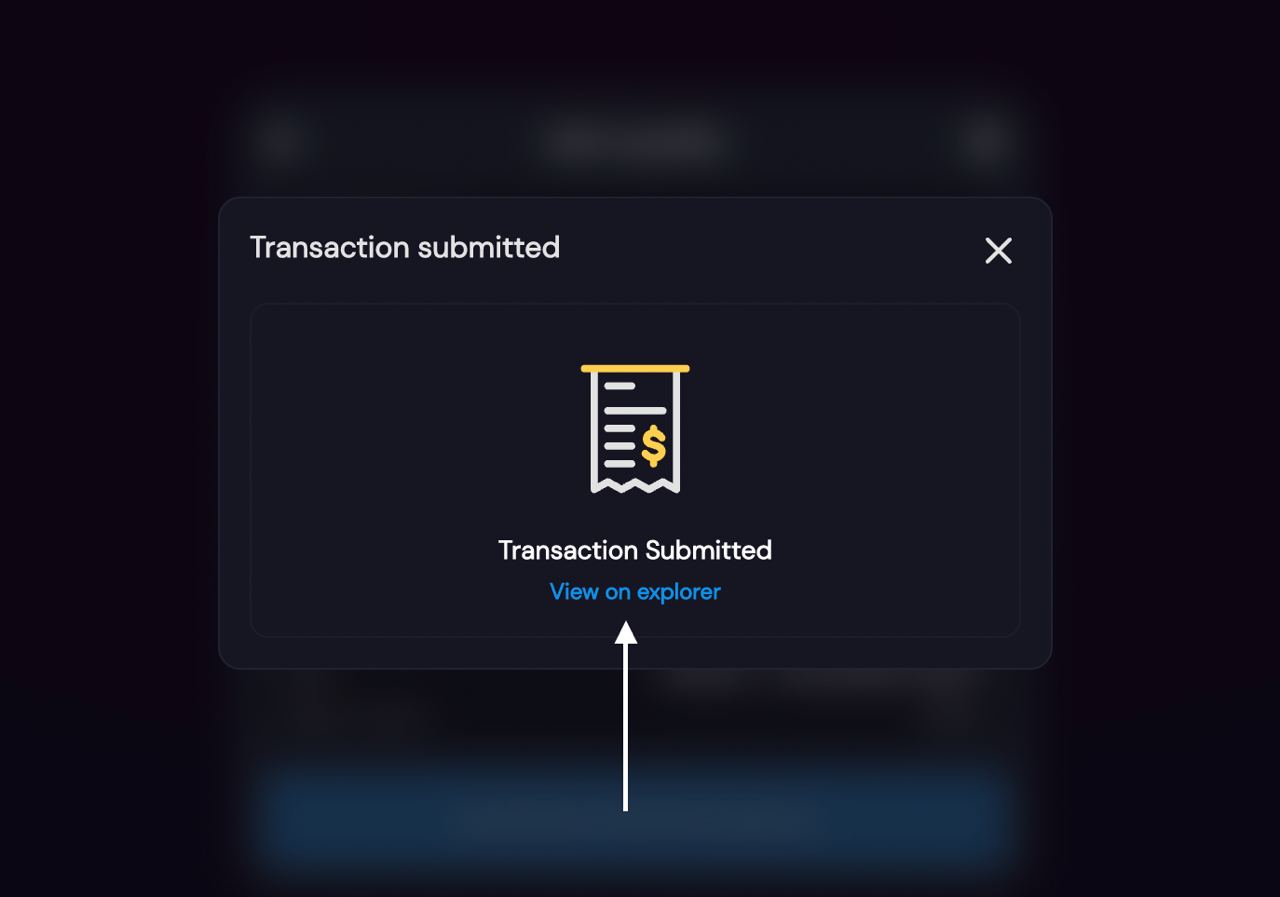

Once confirmed in your wallet you will be supplying liquidity to the $BRICK/ETH pool, and you should see a corresponding $BRICK/ETH SLP Token balance in your wallet.

Click on view on explorer to follow the transaction.

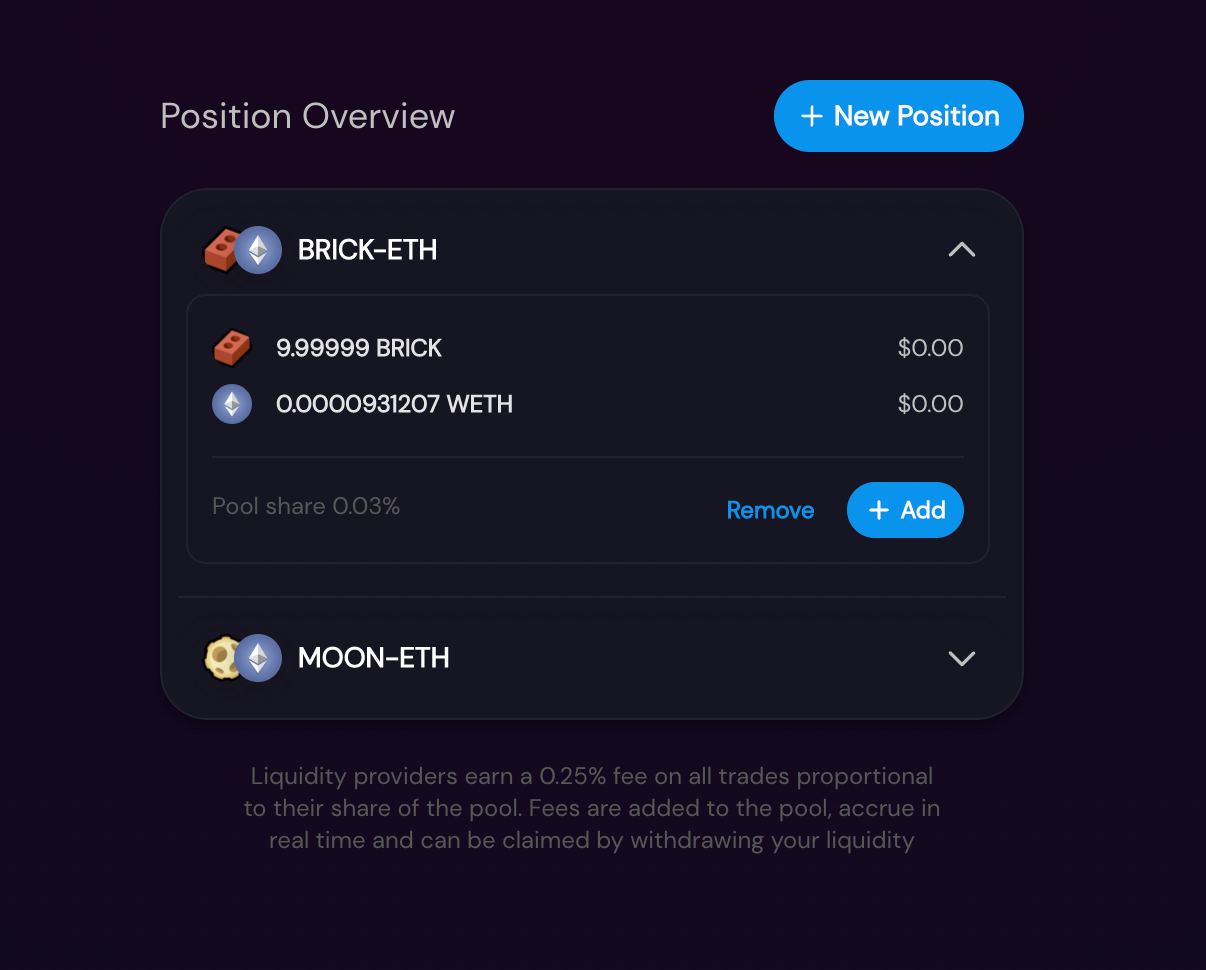

To view your pool position at any time, head over to the menubar and click on "Liquidity" then "Pool". You'll find an overview of and are able to manage all your LP positions from this page.

Congratulations! You have successfully staked your tokens as a "Liquidity Provider" in Sushi. This means when people make a trade you will be eligible for part of the 0.25% trade reward.

Frequently Asked Questions

❓ Why should I become a LP?

Liquidity providers earn a 0.25% fee on all trades proportional to their share of the pool. Fees are added to the pool, accrue in real time and can be claimed by withdrawing your liquidity.

💸 How does the trade fee reward work?

Every time a user trades between $SUSHI and $ETH a 0.3% fee is taken on the trade. 0.25% of that trade goes back to the the LP pool.

ℹ️ What is SushiSwap?

Sushi is a decentralized exchange, we aim to be a one-stop shop for all your decentralized finance (DeFi) needs. Sushi allows users to trade cryptocurrencies without the need for a central operator administrator. We use a collection of liquidity pools to achieve this goal. Users first lock up assets into smart contracts, and traders then buy and sell cryptocurrencies from those pools, swapping out one token for another.

💬 Still got questions?

Hit us up in Discord or on Twitter.

Sushi is building a comprehensive DeFi ecosystem! Follow our socials to keep up with our product launches and find out more on how you can make the most of your cryptocurrency assets with Sushi’s secure and powerful DeFi tools!

Exchange | Furo | Docs | Discord | Twitter | Telegram | Newsletter | YouTube | Github