Technical analysis (TA) is a method of predicting future market behavior by examining historical price action and volume data. It is widely used in both traditional financial markets and the cryptocurrency market, and is often referred to as charting.

In contrast to fundamental analysis (FA), which looks at various factors affecting the price of an asset, TA focuses solely on the asset's historical price movements and volume data. This makes it a useful tool for identifying trends and trading opportunities.

The origin of modern TA can be traced back to the work of Charles Dow, a financial journalist and founder of The Wall Street Journal. Dow was one of the first to observe that assets and markets often move in trends that could be analyzed and examined, and his work later led to the development of the Dow Theory.

TA has come a long way since its early days, where hand-drawn sheets and manual calculations were used. With advancements in technology and modern computing, it has become a widely used tool for many investors and traders.

How Does It Work?

Technical analysis utilizes past price and volume data to predict future market behavior and is based on the idea that fluctuations in asset prices are not random, but instead follow identifiable trends. The price of an asset reflects the balance between supply and demand, which is influenced by market sentiment, emotions, and trader behavior.

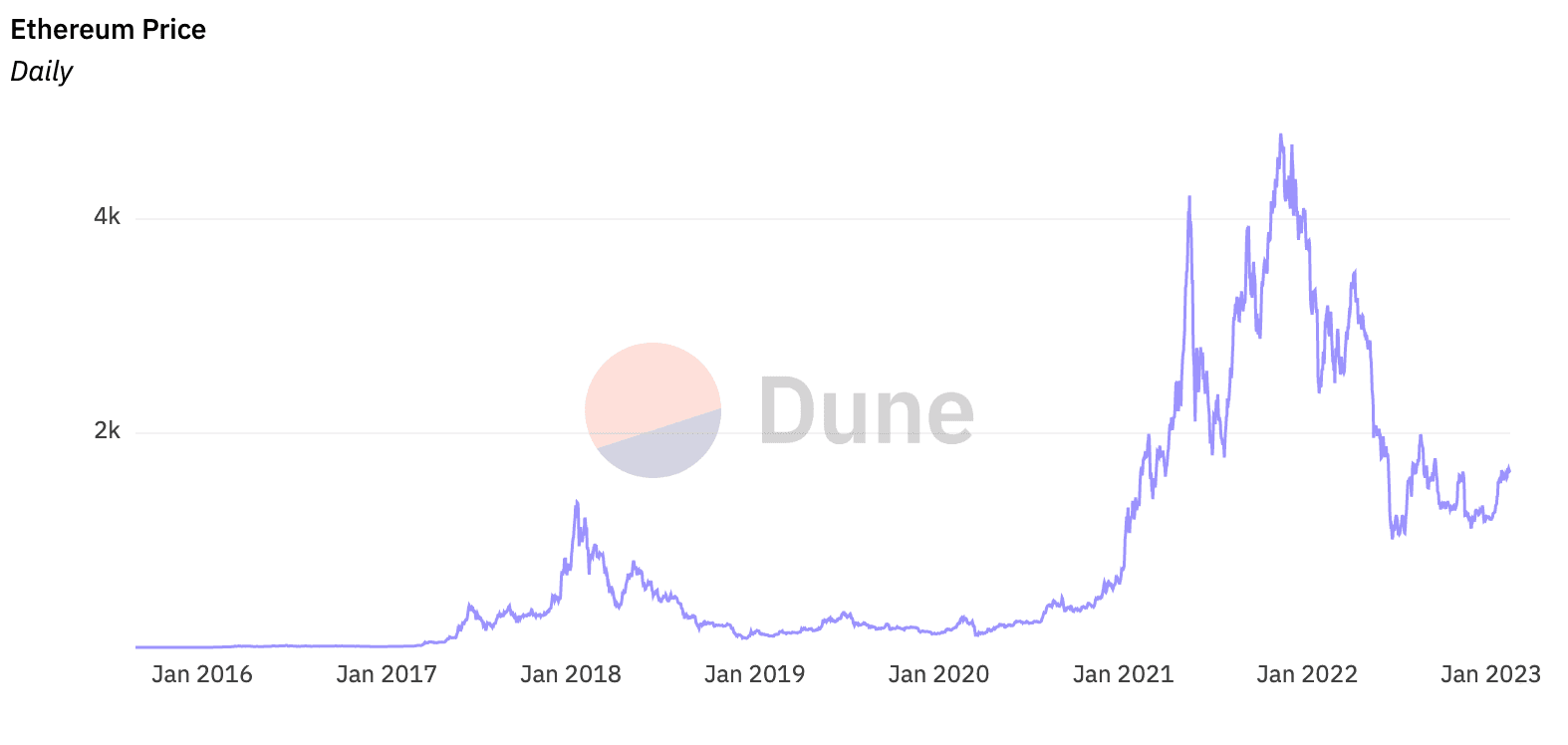

Daily Ethereum price chart for the period Jan 2016 - Jan 2023

TA is considered most effective in high-volume, liquid markets that are less susceptible to manipulation and outside influences. Traders use various charting tools, known as indicators, to help identify trends and favorable opportunities. By using multiple indicators, traders can reduce the risks associated with relying on any one indicator.

The main underlying assumption of TA is that the market forces of supply and demand are a representation of overall market sentiment. This is why the price of an asset is viewed as a reflection of the opposing selling and buying forces, driven by fear and greed among traders and investors.

It is important to note that technical analysis is considered more reliable in normal market conditions, but it can be rendered useless in the presence of abnormal conditions or price manipulations. Despite this, TA remains an important tool for many investors and traders in their market analysis and decision-making process.

Common Indicators Used

Technical analysis traders often use a range of different indicators and metrics to identify market trends and make predictions based on historical price action. Some of the most commonly used indicators include simple moving averages (SMA) and exponential moving averages (EMA). SMA is calculated based on the closing prices of an asset over a set time period, while EMA gives more weight to recent closing prices compared to older ones.

Another popular indicator is the relative strength index (RSI), which belongs to a class of indicators known as oscillators. Unlike moving averages that track price changes over time, oscillators apply mathematical formulas to pricing data to generate readings within a predefined range (0 to 100 for RSI). Bollinger Bands (BB) is another well-known oscillator that is used to identify potential overbought or oversold market conditions and measure market volatility.

There are also advanced technical analysis indicators that are calculated based on other indicators. For example, the Stochastic RSI is calculated using a mathematical formula applied to the regular RSI, while the moving average convergence divergence (MACD) indicator is generated by subtracting two EMAs. The MACD line is created by this subtraction, while the signal line is generated by the MACD line's EMA. Additionally, the MACD histogram is calculated based on the differences between the two lines.

Trading Signals

Indicators are not only used for determining trends but also for providing signals for entry and exit points. When specific events occur in an indicator's chart, it can generate signals. For example, when the RSI reaches 70 or higher, it could indicate an overbought market. Conversely, when the RSI falls to 30 or lower, it could indicate an oversold market.

However, it's extremely important to keep in mind that technical analysis signals are not always accurate and can generate a significant amount of false signals. This is particularly true in the cryptocurrency market, which is much smaller and more volatile than traditional financial markets.

Criticisms

Technical analysis is widely used across various financial markets, but it is also widely criticized as both controversial and unreliable. It is often referred to as a "self-fulfilling prophecy", meaning that it only becomes true because a large number of people believe it will.

Critics argue that when many traders and investors rely on the same indicators, such as support or resistance lines, the likelihood of these indicators working is increased. However, supporters of TA believe that each trader has a unique approach to analyzing charts and using the various indicators, making it unlikely for a large number of traders to use the same strategy.

Fundamental Analysis vs. Technical Analysis

Technical analysis operates under the assumption that market prices already take into account all fundamental factors related to a particular asset, while fundamental analysis is based on a broader investigation strategy that places greater emphasis on qualitative factors. Technical analysis focuses mainly on historical price data and volume (market charts) while fundamental analysis seeks to determine the intrinsic value of an asset by analyzing a wide range of micro and macroeconomic conditions, such as company management, market competition, growth rates, and industry health.

Technical analysis is primarily used by short-term traders as a prediction tool for price action and market behavior, while fundamental analysis is favored by long-term investors and fund managers. The main advantage of technical analysis is its reliance on quantitative data, which provides an objective framework for investigating price history and eliminates some of the uncertainty in the more qualitative approach of fundamental analysis. However, technical analysis is still subject to personal bias and subjectivity, as a trader may manipulate data to support their preconceived notions without realizing it. Additionally, technical analysis may not be effective during periods when markets lack a clear pattern or trend.

What’s The Best Choice?

Many financial experts believe that combining both technical analysis (TA) and fundamental analysis (FA) is a more prudent approach than relying solely on one method. FA is typically used for long-term investment strategies, while TA provides valuable information on short-term market trends, which can benefit both traders and investors in determining the ideal times to enter or exit the market.

Exchange | Furo | Docs | Discord | Twitter | Telegram | Newsletter | YouTube | Github