- Date

Deep Dive: How Smart Pools Generate 8.5x Fees in Sushi v3 With Its New Quick & Easy Mode

A complete breakdown of what smart pools are and how to engage with them.

- Mizu

Welcome to the home of DeFi: Sushi

TL;DR

- Steer Protocol's Smart Pools: Introduces the Quick & Easy Mode to streamline deployment in less than 30 seconds, especially advantageous for those transitioning from v2 to v3, with three percentage spread options (25%, 50%, 75%) and potential earnings of up to 8.5x more fees.

- Automated Liquidity Management (ALM): Dynamic adaptability replaces static liquidity allocations, optimizing returns, reducing risk, and efficiently deploying resources.

- Benefits of Smart Pools: They provide deeper liquidity, reduced slippage, auto-compounding of fees, and collaborations like Merkl rewards and built-in staking with Angle Protocol.

- Performance Fee: Steer Protocol charges a 15% performance fee divided among nodes, strategists, and the protocol itself.

- Considerations: While Smart Pools are efficient, they're not without risks, especially if liquidity ranges are too narrow or if market conditions fluctuate unexpectedly.

Introduction

In our previous write-up, we briefly introduced Smart Pools by the Steer Protocol and how it can help Liquidity Providers (LP) earn more APR in v3 Concentrated Liquidity Pools. This week, Steer Protocol has launched a simplified UI - the Quick & Easy Mode with additional strategies. Let’s do a complete breakdown of what smart pools are, how the new "Quick & Easy" mode works, and how to engage with them.

Why Automated Liquidity Management (ALM)?

If you're managing your liquidity on v3 yourself, the secret to its profitability lies in constantly monitoring and adjusting the pools. While this can optimize returns, it may make you reminisce about the more relaxed nature of v2, even if it came with a lower APR. Now, there's a solution that combines the best of both worlds for you: Automated Liquidity Management (ALM).

Automated Liquidity Management revolutionizes traditional liquidity pools by introducing dynamic adaptability. Instead of static liquidity allocations, ALM actively adjusts to offer better returns, reduced risk, and a more efficient deployment of resources.

Smart pools amplify this concept. When applied to AMM (Automated Market Maker) pools like SushiSwap, they incorporate yield-generating algorithmic strategies, taking the benefits of ALM to the next level.

What's special about Steer Protocol's ALM?

Leveraging Steer Protocol's advanced multi-position strategy infrastructure and off-chain computing,

they provide:

- Superior fees compared to other ALMs.

- Permissionless pool creation.

- Enhanced concentration of liquidity around the current price.

- Deeper liquidity with the same fund allocation.

- Reduced slippage and impermanent loss for traders.

- Auto-compounding of fees combined with amplified rewards, elevating profits and minimizing risks for LPs.

Furthermore, the Steer Protocol collaborates with the Angle Protocol, introducing Merkl rewards and built-in staking modules. This not only elevates yields but also offers a safety net, minimizing risks for liquidity providers.

In return, Steer Protocol takes a 15% performance fee from your profit: 5% goes to the nodes, 5% to the strategist who built the strategy (which anyone can build one) and 5% to Steer Protocol.

Introducing the Quick & Easy Mode

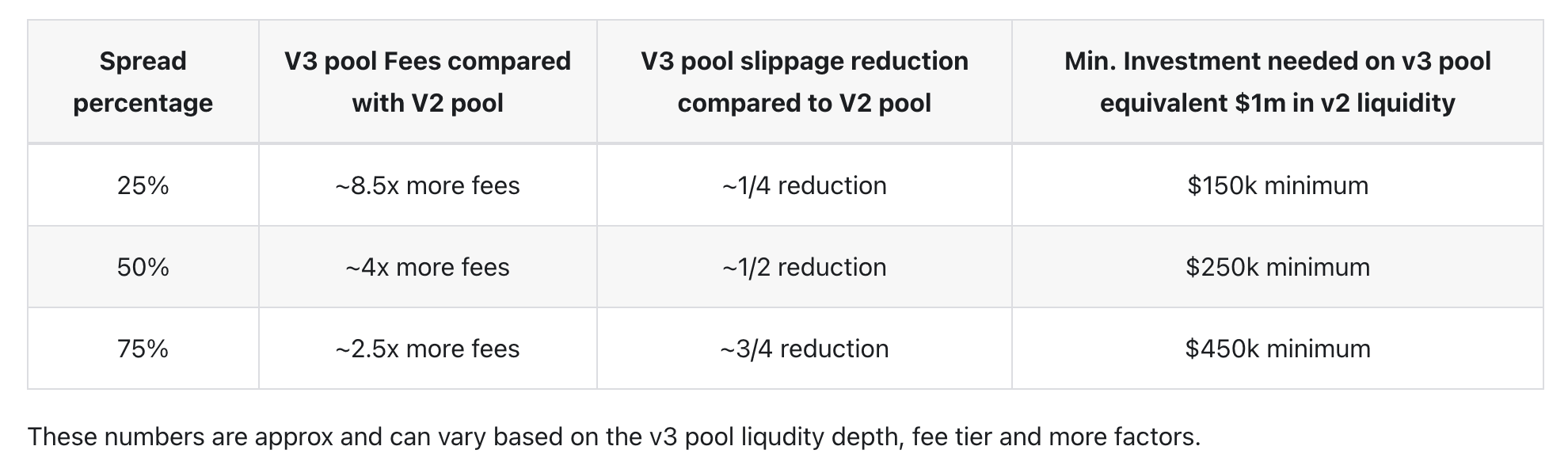

The Quick & Easy Mode from the Steer Protocol streamlines the smart pool deployment process.It's particularly advantageous for those transitioning from v2 pools to v3 for better capital efficiency. There are 3 options of percentage spread (options: 25%, 50%, 75%) to match your risk appetite with up to 8.5x more fees earned. See details below.

This mode is a harmonious blend of simplicity and sophisticated strategy. Looking for more options? Try Steer Protocol’s Advance mode, there are 6 strategies with different risk and return profiles.

Read more about the strategies here: Link

Benefits: Up to 8.5x more fees than v2 pool

- Enhanced Returns: Up to 8.5x

- Enhanced capital efficiency: reduction in slippage for traders and increased market liquidity

- Convenience: A straightforward setup process reduces complexities - you can complete the process in less than 30 seconds.

- Efficiency: Combines the best of v2's “set & forget” and v3's “capital efficiency”

- Passive Management: Once set, there's no need for frequent adjustments – just "pool and chill."

- Proven Strategy: Strategies deployed by Steer Protocol have been back-tested for reliability and efficiency. For pools deployed by users, there’s a backtesting platform users can backtest their strategies. Link

Considerations

Steer Protocol's Smart Pools are proven to offer a range of distinct benefits. While there are considerations to keep in mind, for instance, If a liquidity range is set too narrowly, prices moving out of that range may require frequent rebalancing or high IL, incurring additional gas fees.

Furthermore, while the strategies employed have been back-tested for reliability, they carry inherent risks; market conditions can change, and past performance isn't always indicative of future results. It's essential for users to weigh these factors when diving into this promising venture.

How to Set Up a Smart Pool?

- Visit Steer Protocol.

- Search: Initiate by searching for a pool via the token symbol.

- Mode Selection: Opt for the "Quick & Easy Mode."

- Risk Evaluation: Choose a percentage spread around the current price to match your risk appetite (options: 25%, 50%, 75%). Note: The wider the range the safer the position.

- Review: Check the liquidity graph and anticipate outcomes.

- Gas & Frequency: Decide on the gas amount and strategy execution frequency, determining the regularity of pool optimizations. Keeping this balance healthy is key to a successful Smart Pool.

- Deploy: Once content, activate your Smart Pool!

Watch the demo here: Link

What’s next?

Currently, Steer has 11 live networks with 140+ pools available. With the introduction of the "Quick & Easy" mode today, Sushi has become the protocol with the most pools available.

What's Next for Sushi: As we highlighted just two days ago, Sushi is preparing to integrate Steer natively into its user interface. This will offer Liquidity Providers (LPs) the option to have Steer manage their liquidity, aiming for higher APRs with reduced risk.

Experience the "Quick & Easy" mode here.

Exchange & XSwap | Docs | Discord | Twitter | Telegram | Newsletter | Youtube | Tutorial | Github