- Date

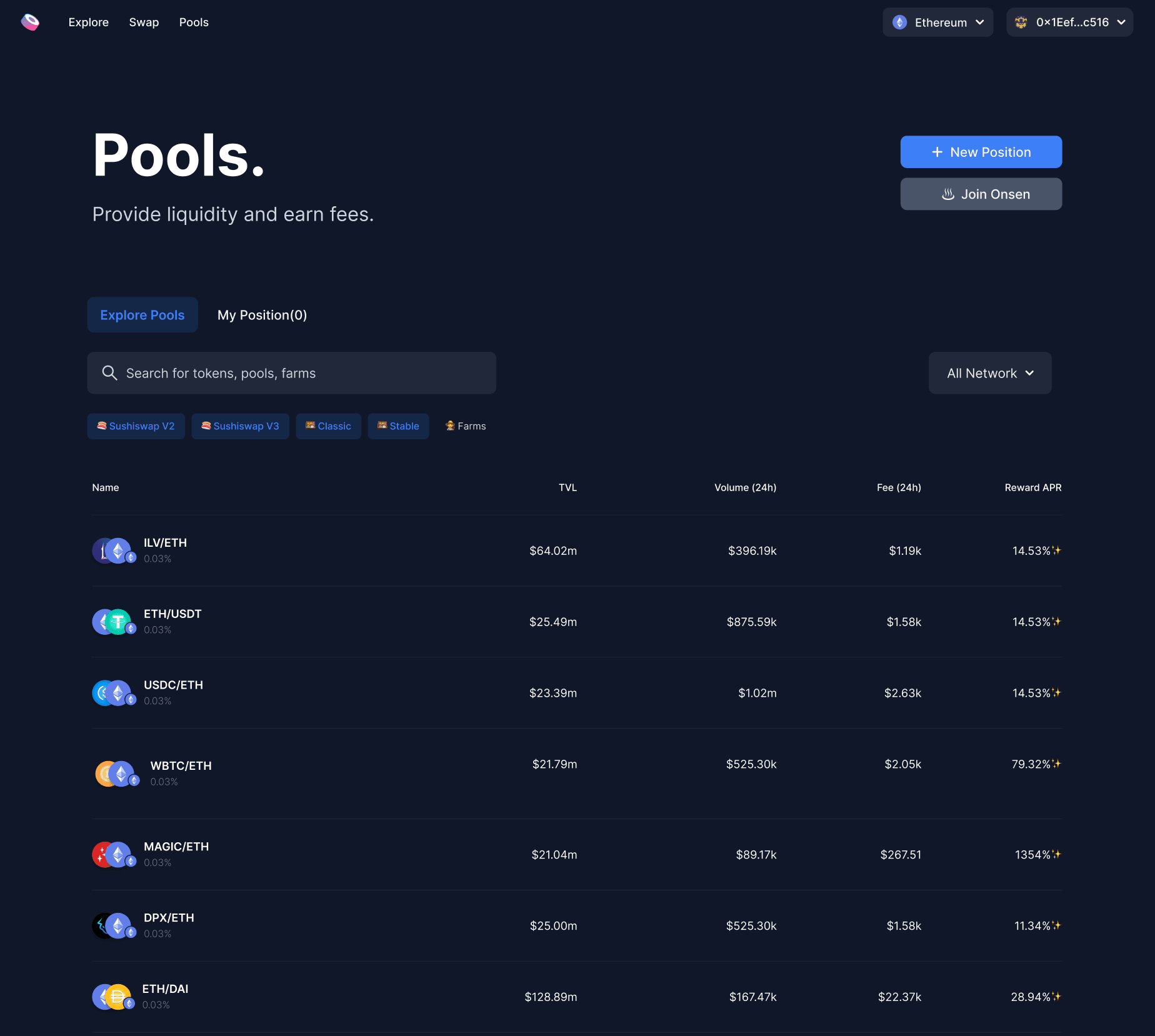

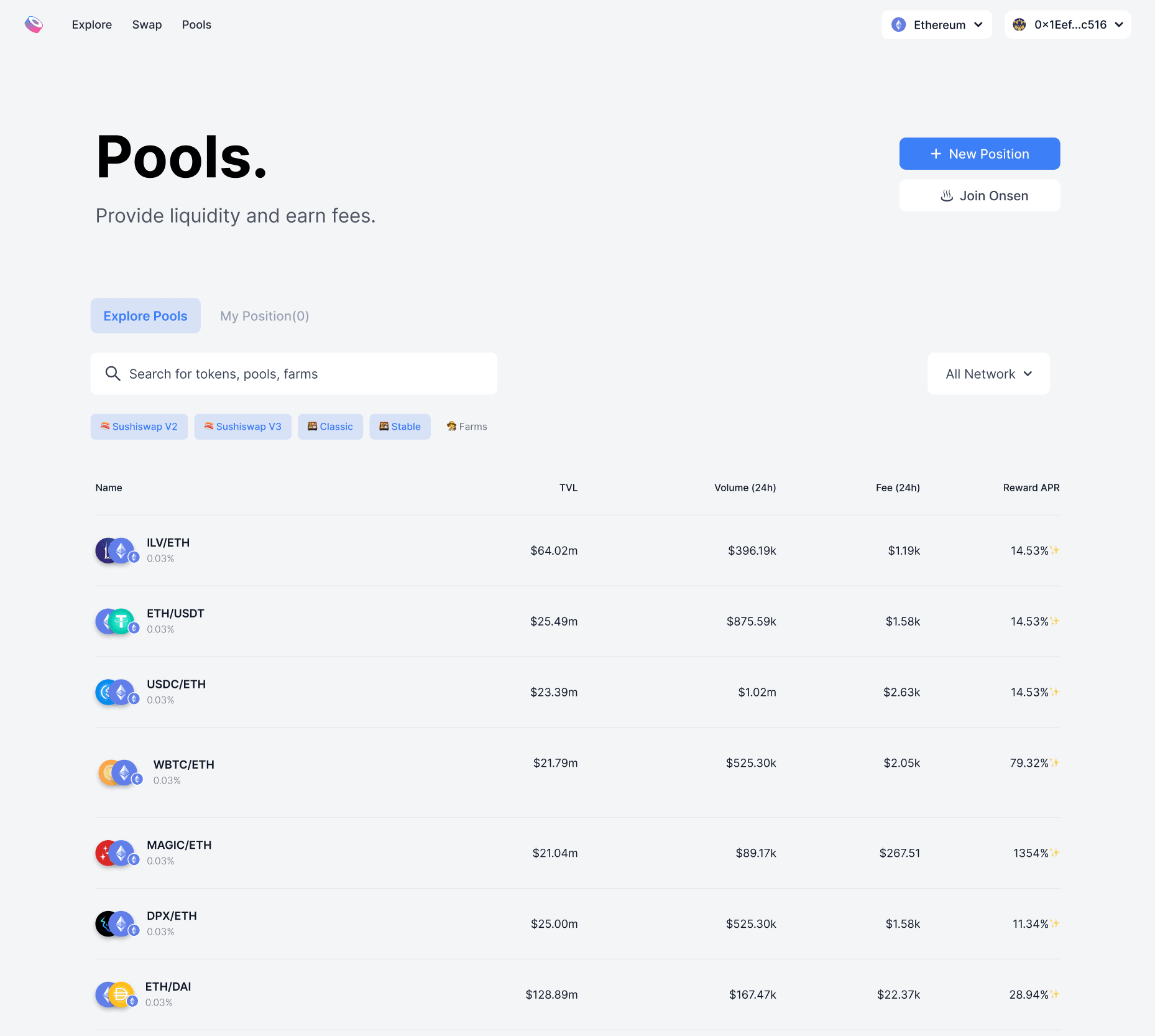

Sushi Concentrated Liquidity v3 Is Live! (Updated on 24 July 2023)

Concentrated Liquidity, Everywhere. Capital Efficiency, Anywhere.

- 0x_Bella

Welcome to the home of DeFi: Sushi

TL;DR

- Concentrated Liquidity (CL) in DeFi allows liquidity providers to concentrate their funds in a smaller price range, leading to improved capital efficiency and reduced slippage.

- Sushi is a adopting CL, and its v3 introduces improvements and multichain deployment across 20 networks.

- Smart Pools by Steer Protocol offer advanced LP management and risk mitigation strategies, integrated with Sushi.

- Sushi's v3 comes with a new, user-friendly UI, light/dark mode, step-by-step UX guidance, and innovative routing for cost-efficient swaps.

- Sushi plans to expand CL to more networks, introduce a rewards program for efficient LPs, and collaborate with partners for enhanced features.

- The goal is to provide a user friendly v3 experience, attracting more users to participate in the DeFi ecosystem on Sushi.

- Try it out now: https://sushi.com/pools

Concentrated liquidity has emerged as a game-changer in the DeFi ecosystem, and Sushi is at the forefront of its adoption. The focus of v3 is predominantly on Concentrated Liquidity, along with a series of improvements. Let’s break it down:

What is Concentrated Liquidity?

Concentrated Liquidity allows liquidity providers (LPs) to concentrate their funds in a smaller price range around the current market price, instead of evenly distributing them on the curve. Concentrated liquidity pools offer several benefits:

Capital Efficiency:

Concentrated liquidity pools enable LPs to deploy their capital more efficiently compared to traditional liquidity pools. LPs can provide liquidity with fewer tokens, covering a narrower price range. This means that LPs can profit more from the specific price range where most trading activity occurs, in contrast to the broader price range required in traditional liquidity pools. The focus on the most traded price range allows LPs to optimize their capital utilization and maximize their potential returns.

Reduced Slippage:

By concentrating liquidity in a smaller price range, the spread between buy and sell orders is significantly reduced. This reduction in spread translates to lower slippage for traders, allowing them to execute trades with greater precision. As a result, traders can enjoy improved trading volume and liquidity, enhancing their profit potential.

Reduced Impermanent Loss:

Concentrated liquidity pools on Sushi significantly reduce impermanent loss for liquidity providers (LPs). By concentrating liquidity around the current market price, LPs can narrow down the price range, minimizing their exposure to volatile price swings and optimizing their capital utilization.

Sushi's v3: Concentrated Liquidity, Everywhere. Capital Efficiency, Anywhere.

Concentrated Liquidity is a novel product feature and at Sushi, we are continuously making improvements., offering unique advantages to traders and LPs:

Multichain Deployment:

Sushi has launched Concentrated Liquidity pools (v3) on 20 networks, making it the most comprehensive deployment of V3 pools to date. With additional networks planned for integration in the near future, Sushi aims to provide a seamless experience for users and LPs across various blockchain networks.

- Arbitrum

- Arbitrum-nova

- Avalanche

- BNB Chain

- BitTorrent Chain

- Boba Eth

- Boba Avax

- Boba BNB

- Celo

- Ethereum

- Fantom

- Fuse

- Gnosis

- Harmony

- Huobi ECO Chain

- Kava EM

- Metis Andromeda

- Moonriver

- Moonbeam

- Optimism

- Palm

- Polygon

- Polygon zkEVM

- OKXChain

- Telos EVM

- ThunderCore

Try it out now: https://sushi.com/explore

Smart LP Management Integrations

Smart Pools by Steer:

While the benefits of v3 Concentrated Liquidity (CL) pools are widely recognized, it's important to acknowledge that active management is crucial, particularly when dealing with highly volatile tokens. This is where the Smart Pools by Steer Protocol come into play, offering enhanced management capabilities and risk mitigation.

Steer Protocol's Smart Pools provide advanced features and LP strategies to simplify the management process for LPs within a few clicks. By leveraging advanced automation and intelligent algorithms, Steer simplifies LP management, reducing the time and effort required for active portfolio management. LPs can enjoy benefits such as optimized capital allocation, risk mitigation strategies, and seamless integration with Sushi's ecosystem. The feature is currently available on the Steer UI which will be soon available natively on Sushi.

Get started: https://app.steer.finance

Smart strategies by Gamma v2:

Addressing the same issue of v3, Sushi v3 Concentrated Liquidity is now live on Gamma v2 to offer automated LP management with smart strategies like "Narrow," "Wide," and "Stable," each suited for varying risk levels and market conditions, allowing LPs to maximize their earnings with less time and risk. Merkl by Angle Protocol, also integrated in Gamma, enables LPs to claim $SUSHI rewards without staking their LP positions. Currently, it's on Polygon and Arbitrum. Try it now!

Introduction & Walkthrough: Link

Get started: Gamma v2

Others:

Maximum Simplicity and Intuitive UI

Accompanying our concentrated liquidity release, we’re proud to introduce a new, improved UI for max simplicity and an effortless user experience. We’ve implemented the following:

Light & Dark Mode

You can now trade more comfortably by choosing the mode that suits your preference.

Step-by-Step UX Guidance

Guiding users for each step involved in adding liquidity.

Price Range Selector

Graphical representation of the price range a user intends to provide liquidity.

Innovative Routing

The v3 release includes a brand new route processing contract for our in-house smart order routing system, Tines.

Together, Tines and the new route processor (RouteProcessor3) unify liquidity across all of Sushi by enabling pools of all types to interact with each other, effectively creating a large pool of liquidity to trade against. Tines will construct the most cost-efficient route for a swap to take based on the current conditions, then will execute the swap that has the lowest price impact. This design ensures users get the cheapest swaps possible with maximum capital-efficiency.

How to LP on Sushi V3?

Getting started with Sushi's concentrated liquidity pools is straightforward:

-

Visit Sushi.com/explore: Head to the Sushi website and navigate to the "pools" section. Here, you'll find access to Sushi's concentrated liquidity pools.

-

Create Position: Select the network of your choice from the available options. Sushi currently supports concentrated liquidity on multiple networks, including Ethereum, Polygon, Avalanche, BSC, and more.

-

Set Fee Tier and Price Range: Choose the fee tier for your pool, ranging from 0.01% to 1.00%. Lower fee tiers suit more stable pairs, while higher tiers are better for volatile pairs. Then, define your desired price range for providing liquidity by specifying the minimum and maximum values. This range determines the degree of price fluctuations you expect over time.

-

Preview and Confirm: After defining the price range, set the initial price within that range, and enter the desired amount of liquidity for each asset. Review the pool details in the preview, ensuring everything is correct. If satisfied, click "Add Liquidity" to create the concentrated liquidity pool.

See this full tutorial for details.

What’s Next?

Sushi's commitment to concentrated liquidity doesn't stop here. The platform has exciting plans for the future:

Phase 1: Multichain Rollout:

Sushi aims to expand the deployment of concentrated liquidity pools across 30 networks. The first phase includes the rollout of v3 on 20 networks, with plans to cover all 30 chains live on Sushi. Additionally, Sushi plans to deploy its full DEX to zero-knowledge rollups, further enhancing the ecosystem's capabilities.

Phase 2: Rewards Program:

In the next phase, Sushi will introduce a unique rewards program for the most efficient LPs. LPs will have the opportunity to earn additional $SUSHI as a reward. The rewards program will initially be available on Ethereum, Arbitrum, Optimism, and Polygon, with more chains being added over time.

Phase 3: Native Smart Pools powered by Steer on Sushi

First it will be available on Steer UI, and next it will be available on Sushi providing a native experience.

Furthermore, Sushi has been collaborating with exciting partners who have built on top of their v3 pools. These partnerships will bring additional features to simplify and automate the v3 LP experience, further enhancing the overall trading experience on Sushi.

With its comprehensive concentrated liquidity deployment, cross-chain infrastructure, and improved user interface, Sushi is committed to leading the way in developing the DeFi ecosystem. Users and LPs can expect a better trading experience, increased capital efficiency, and seamless management of funds across various networks.

Try it out now: https://sushi.com/explore

Sushi is building a comprehensive DeFi ecosystem! Follow our socials to keep up with our product launches and find out more on how you can make the most of your cryptocurrency assets with Sushi’s secure and powerful DeFi tools!

Exchange | Furo | Docs | Discord | Twitter | Telegram | Newsletter | YouTube | Github